In parallel with the growth of bitcoin or Tesla, forum members on r/WallStreetBets on Reddit have grown exponentially in 2020. The number of subscribers to the sub-reddit grew 133% to 1.8 million members last year. This growth accelerated further this month, and the current 2.2 million members of the forum now host one of the most active pages on the platform.

Discover our latest podcast

Members have spent the past three weeks bidding on the video game distributor GameStop, and the results have been spectacular. Stock prices have soared more than 1,200% since WallStreetBets started taking care of it on January 11. The magnitude of the rise has resulted in billions of dollars in losses for short sellers (a risky market move that has the seller 'bet' on a company's failure to make money).

According to @S3Partners, short sellers lost $14.3 billion on $GME stock today... 𝙟𝙪𝙨𝙩 today.

— Riley de León (@RileyCNBC) January 27, 2021

WallStreetBets had already influenced the stock market before. Stock-interested members have bragged about the influence they have had on the stock market in the past, like making bankrupt car rental giants, or taking a Chinese coffee chain off the stock market. They are particularly interested in shares of electric vehicles; Tesla enjoys a unique enthusiasm on the forum, for example. The CEO reciprocates:

Gamestonk!! https://t.co/RZtkDzAewJ

— Elon Musk (@elonmusk) January 26, 2021

Nevertheless, previous reddit-fuelled movements generally lasted just a few days before the profit collection brought prices back to normal. Reddit's new-found obsession for GameStop does not seem destined to subside, however. To put it simply, the sub-reddit amplified a stock's value, created a risk that attracted new investors, and surprised the Wall Street giants.

This is how these snowballing tricks were born.

Monetize the meme

Reddit promotes itself as 'the first page of the Internet.' Part social network, part information flow, and part discussion forum, the platform is host to a diverse set of communities ranging from r/WorldNews to r/BabyElephantGifs. Posts and comments are public, and those receiving the most positive votes from other users are highlighted.

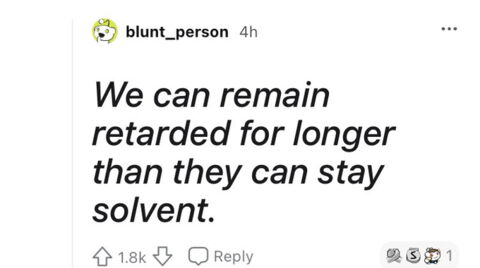

On WallStreetBets, members frequently brag about their exceptional gains—and, in some cases, their losses—and joke about their stock market strategies.

During the GameStop saga, several messages from WallStreetBets with tens of thousands of upvotes, flooded the page with the biggest hits. Countless users, unfamiliar with WallStreetBets, were encouraged to join in the rush as the snowball began to roll, often through posts showing multi-million dollar gains on GameStop stocks.

That behaviour is not wholly unknown, though. The GameStop rally is 'absolutely' a temporary affair, running at a specific time, on a 'very short notice.' Dr. Richard Smith, CEO of the Foundation for the Study of Cycles, told Business Insider US. A 'momentum trade' is characterized by the fact that investors rush to emulate a lucrative investment.

It's a human emotional cycle. And now you have more Internet users at home, glued to their computers. It's all the fuel for the acceleration of these sentimental cycles.

Incidentally, there is also financial gain to be made for those looking to gain notoriety on the Internet. Reddit users can reward posts and comments with various virtual medals, many of which can only be offered through the use of real currency.

The most popular post of the week, on WallStreetBets, which boasts of a 992% profit on the shares of GameStop, received $765 (approximately £554) in reward, according to an online calculation program.

'Institutions are losing some of their hegemony'

The structure of Reddit and its democratic nature, where users choose the most popular content, is radically different from Wall Street research reports and market analysis. Yet both generate ideas that proliferate among market players. And WallStreetBets' ability to turn free user tips into hugely viral media has apparently been underestimated.

You have these visual-driven platforms where advice is not controlled by institutions, as they always have been. It really is a sign that the institutions are losing control a bit.

Many WallStreetBets members advertise GameStop shares as a safe way to get quick wins. And they were largely right. After seeing a first rise about two weeks ago, gains have continued to grow sharply and have risen to over 300% this week alone, until the close on Tuesday.

Others rally investors to the cause by portraying GameStop shares as an anti-establishment movement, an intermediary in an industry that has always played to its advantage and driven money for the those in need towards the rich. They claim they can beat the hedge funds rackets that have dominated Wall Street for so long. Many see this as a way to punish those responsible for the 2008 crisis that hurt so many, with no retribution until now.

Consequence: the hedge fund Melvin Capital lost 14,3 billion dollars (£10,5 billion) from its ill-advised short sells. They will receive an investment of 2,75 billion dollars (£2 billion) from Citadel and Point72 Asset Management to compensate for its heavy losses due to the failure of its short selling strategy with GameStop, according to Wall Street Journal.

They are not the only one rallying behind established groups. Online brokers, the main way for the average internet user to try their hand on the market, have stopped responding one after other. Making new accounts has become very difficult, and some platforms have gone dark entirely. William Galvin, a top securities regulator in Massachusetts said the New York Stock Exchange should halt trading in GameStop stock for 30 days so it can 'cool down.' Something internet users perceive as Wall Street giants rigging the game for themselves now that they are on the losing side for once.

“The shorts have had their way with the market for decades, and no one has ever complained about it, so i am thrilled, that individual investors are playing the same game, and now you (big hedge funds) are losing” - Charles Payne.https://t.co/SGD6KhoRR5

— wsb mod (@wsbmod) January 28, 2021

Discord, a very popular forum system also shut down WallStreetBets' servers on alleged hate speech. They also mentioned the subreddit's actions as 'financial fraud,' something which many pointed out to be factually wrong. A risky move, considering these users may now have more than enough money to launch libel suits.

When you can feel like a rebel going against the establishment, it's a very powerful emotion. This is what contributes to this amplification of stock value. Read the language on the forum, it's very 'us versus them.' It's very powerful.